by Mrs C | Aug 11, 2021 | Blog

The life of a parent is full of responsibilities and stressors, but it also comes with a variety I’m awesome experiences that make it worthwhile. One of the things you need to do as a parent is to try to help your children to develop good habits that will help them to be financially secure later in life. That’s a pretty big task to take on but with a little planning, you can definitely make it happen.

Help Them Save for College

One of the most important financial things your children have coming up as they near adulthood is being able to pay for college. Helping your children to start saving for college now will help them to develop a habit of saving. One way to make this happen is to match the savings they put into their college fund. You can also put a certain amount of money towards their college on their birthday each year. In addition, you should encourage them to regularly contribute to their own college fund, so they develop a regular habit of saving money.

Create an Estate Plan

Many people are nervous to create an estate plan and try to put it off as long as possible. However, creating a plan for your estate is essential, especially if you are a parent. Everyone with a family needs an estate plan to carry out last wishes and secure children’s future. Planning your estate also helps you to lead your children by example and show them the importance of planning for the future. No one can ever know exactly what life has in store for them but doing your estate planning can help you to prepare your children financially for the future.

Teach Them about Budgeting

One of the most important skills a person should have is the ability to budget effectively. This is a skill that you should start teaching your children as early as possible. At first, you can teach budgeting by simply showing your children how you do things like budget for groceries and meal plan. As they get older and have more of their own money you can help them to budget to save for things they want.

Every child deserves the best possible chance for financial success when they grow up. As a parent, you have the power to help them build that success in their childhood and continue learning about finances as they get older. Then they will be able to live their adult lives independently and securely.

Read this next: How to Make Sure Your Family Gets Adequate Health Treatment

by Mrs C | Aug 11, 2021 | Blog

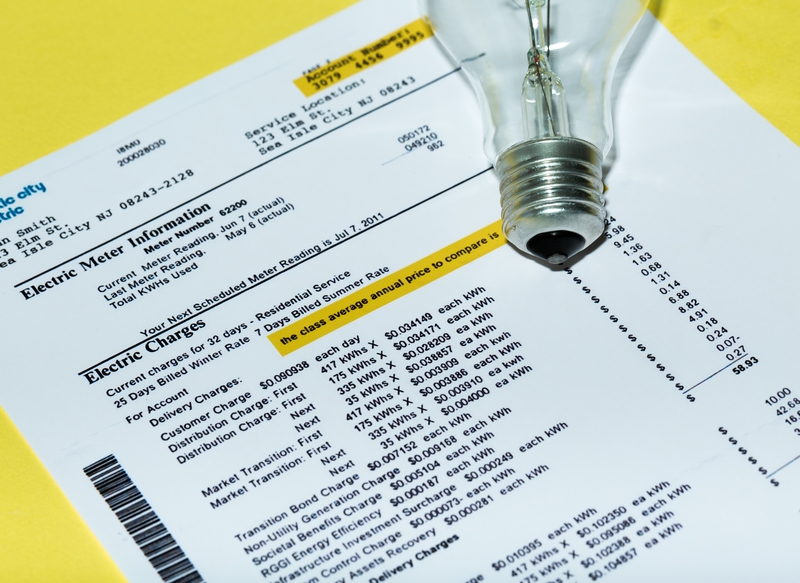

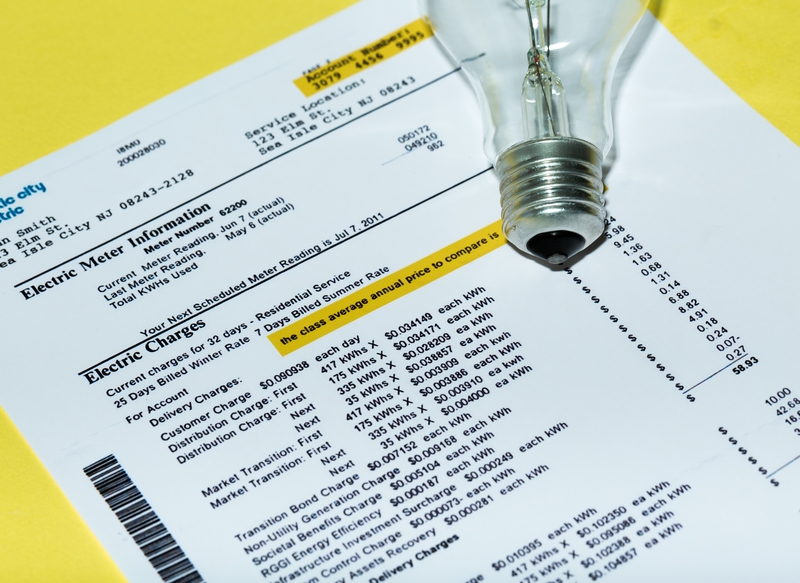

It’s a horrifyingly hot summer in the US, and until we turn back the clock on climate change, that’s not changing. With some states experiencing record temperatures of 119-123 degrees Fahrenheit, and homeowners attempting to remain cool however they can, it’s important to save both energy and your money when cooling your home. Here’s how to help save money on your energy bills.

Window Tinting

There are more options than ever before for both UV protectant and decorative appeals. Many run between 5 and ten dollars a square foot, plus installation. There are professional grade tints which are professionally applied, custom cut to perfectly fit your window. These are longer lasting than the customer grade materials available to self-cut, though there have been better options for purchase in that realm as well. However, when installing on your whole home, and with the goal to reduce electricity costs, hiring an expert is really best. They not only are well practiced in their specialized field, but they also understand what sort of sun is hitting varied windows in your house, and how best applications can help you.

Solar Panels

Solar hardware produces clean, renewable electricity at little to no cost which can then be used to power everything in your home. Your local energy company would love to install solar panels on your house, and to maintain them for you while giving you a discount. There are state options for savings at the moment, but you’ll need to act quickly to purchase before the end of 2021. Banks are offering loans for solar panels, and generally the cost is paid off in just a few years, leaving the remaining savings in your own account.

Insulation

You need a loft of over twelve inches of standard blown insulation. There are excellent options for expanding foam insulation, which are slightly more expensive, but exceptionally effective for insulating within walls. While insulating a 1200 sq foot home might cost around a thousand dollars, if you’re saving sixty to a hundred dollars a month in energy costs, your initial cost will be paid off in a little over a year, if not less.

You want to be doing your best to keep your family cool during this climate disaster, until our leadership nationally chooses to encourage corporate changes which will curb the shift. Until then, do what you can, write to your senators, and stay cool!

Read this next: How to Take the Financial Stress Out of Your Life

by Mrs C | Aug 10, 2021 | Blog

Buying a house when the market is hot is a complicated prospect. You want a home, but it seems like any time you even begin to look it gets snatched out from underneath you. You have a list of things you want, and things you need, and that makes things confusing as well. How can you avoid making major mistakes when buying a house, especially in a hot market?

Hire a Real Estate Agent

It can seem like it would take less effort, or save on commission, to not have an agent. However, especially in a hot market, having an agent is key to finding and getting a contract on a home. They have access to knowledge about market trends, homes about to be listed, and other insider information. According to Investopedia, a good agent will be able to narrow down what things you need and want and show you those homes, so that you can make a decision quickly if necessary.

Get an Inspection

It can seem like a nice shortcut to jump over having house inspections and whatnot but do not skip this critical step. Your agent can help you find a good inspector. According to J Bixler Inspections, inspections typically take several hours to complete. They should be thorough. You and the owner should both be there if possible, during the inspection, but if not, your agent can act on your behalf. You should get the written notes, and your agent can help you with further negotiation.

Money Matters…Matter

According to Pat O’Brien and Associates, one of the biggest mistakes buyers make is not getting preapproved with their lender and knowing how much they can actually afford. It can be easy to fall in love with a home just outside of the amount your agency or lender says you can afford, but not realize that there are other factors at play with your finances. When lenders approve you, they consider how much you make as a factor of how much you can afford. They do not, however, factor in medical bills, educational loans, child support, or other factors which affect your money.

It’s critical to have all your finances in line before searching for your new home. With a great agent, you can get everything in line, with an inspection, and contracts. Have a list of your wants and needs in a home. Pretty soon you’ll be moving into a beautiful new home with all the amenities you’ve desired!

Read this next: How to Find a Place to Live When the Housing Market Has Priced You Out

by Mrs C | Jul 28, 2021 | Blog

Getting into a car accident can be stressful. It can be difficult to remember all the steps you should take afterwards. If you are in an accident that is not your fault, you need to make sure you get fairly compensated. Here are a few things you should remember to do to make sure you get the compensation you deserve.

Gather Information From the Other Party

The first thing you need to do is collect info from the other party in the accident. You should start by getting their name as well as their address and a way to contact them. This information is helpful if you have any questions later about their insurance. Getting the insurance information is one of the most important things for you to do. You should make sure you at least get the name of the insurance company. You will also need the insurance policy number. In addition to this information, you should make yourself aware of the model/type of car that the other party owns, their registration number and license plate number. All the information you gather will help you file your insurance claim.

Make an Insurance Claim

Your next step is to make an insurance claim. Your insurance company should help you through this process. One thing you should remember is to stick to the facts. Don’t include the emotional side of things. Just describe what happened. The information you gathered beforehand will help you create an accurate report. When you make a claim in order to get compensation, it can be difficult to do alone. If you try to represent yourself, the insurance company may not compensate you for an injury. It would be beneficial to hire an attorney.

Understand the Compensation You Need

When in a car accident, there are many types of compensation you can receive. You should make sure you understand what applies to your specific case. The first type of compensation you should consider is coverage for any damage to your car. If you were injured in the accident, you can receive compensation for your medical expenses. Your injury may also prevent you from working and you may be entitled to compensation for loss of wages. Compensation can also be paid for any additional suffering, damage to your relationships, and even loss of enjoyment.

If you have been in a car accident that isn’t your fault, then you are entitled to certain types of compensation. You just need to make sure you take all necessary steps to get it. If you need help, talking to an attorney can make the process easier.

Read this next: How to Make Sure Your Family Gets Adequate Health Treatment

by Mrs C | Jun 17, 2021 | Blog

Out of all the types of stress you may be dealing with, intense financial stress can cause you some of the most severe anxiety. Even more than anxiety, acute financial stress can result in migraines, insomnia, and even cardiovascular disease. Figuring out a way to manage this stress should be one of your top priorities.

Stay Out of Debt

Staying out of debt is perhaps the most important way to minimize financial stress. When you don’t have any debt, you don’t have to worry about paying off hefty sums with ever increasing interest. The best way to stay out of debt is to build good financial habits. According to Bankrate, you should start with building a budget.

Budget out your money towards housing, food, insurance, internet, car payments, and any other relevant expenses. Try to have money left over that you can save or invest. This allows you to make your money work for you.

Build an Emergency Fund

After you’ve built a budget, work to build an emergency fund. Whether you’re a college student or a mother of three kids, you need to have money set aside for emergencies. Your emergency fund might look different depending on your financial situation but just focus on starting to build one. Even if you only have a couple hundred dollars in your fund, that’s a good start.

According to Power Finance Texas, high-yield savings accounts at online banks are ideal for keeping your emergency fund. With a high-yield savings account, your bank pays you a higher interest rate for keeping your money sitting in the account. This is great for you because emergency funds are only withdrawn in the unlikely case of an emergency.

Build Your Credit

Financial stress manifests itself in the day-to-day when you worry about paying too much for gas or when you’re berating yourself for eating out too much in a week. But financial stress becomes especially poignant when it comes to big expenses like buying a house or a car.

According to CFP, if you invest time now into building your credit, you could reduce the interest rates you get on a home mortgage significantly, possibly resulting in thousands of dollars of savings.

If you are in debt or are struggling to pay your bills, figuring out how to dig yourself out of that hole can be overwhelming. Take a deep breath and start with one step at a time. Making simple goals and then achieving them one by one will help you gain motivation and confidence while you strengthen your financial situation bit by bit.

Read this next: Fun Family Activities that Save Money